The past two years has seen a resurgence in domestic holidays as travellers stay closer to home due to Covid-enforced travel restrictions and isolation requirements, combined with a greater awareness of climate change and the environmental impact of travelling.

Our research has found 17% of UK adults considered buying a holiday let during the past two years, equating to over 10 million people*. That’s a big number of potential landlords!

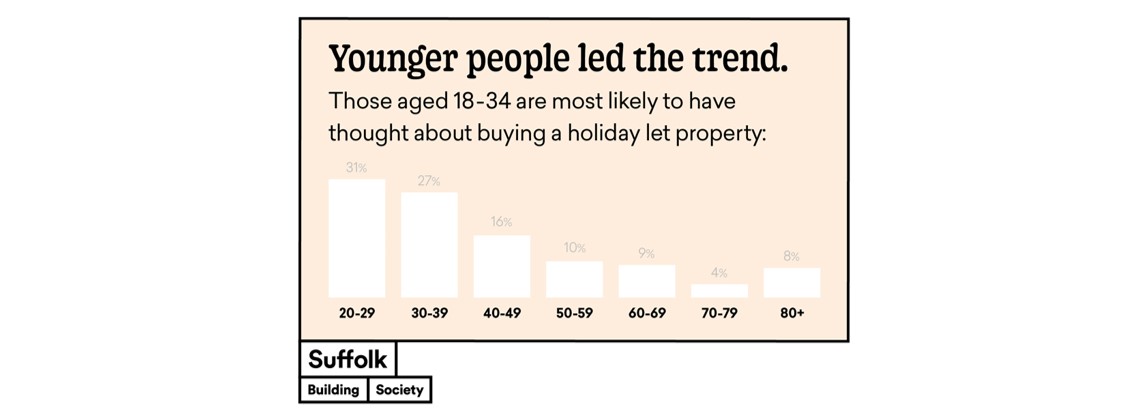

Interestingly it was younger people leading the trend, which could open up a new client group for intermediaries with real expertise in the holiday let market given many lenders’ criteria for holiday let comes with a minimum age and existing home ownership, or even landlord, requirement.

Two urban areas had the highest number of prospective landlords, with those living closest to London at 32%, followed by people in the West Midlands (19%).

Of those who expressed their interest in becoming a holiday let landlord, almost a third, (32%) said Covid-related restrictions inspired them to look into holiday lets, however, half (50%) claimed it was always part of their plan.

Perhaps not surprisingly, the setting of the property was the most important factor for potential landlords.

- A property that is in or near beautiful scenery (31%)

- A property that is near the beach or coast (30%)

- A property that is easy to manage and doesn’t require much upkeep (28%)

- A property that is in an area that the landlord already personally knows or loves (27%)

- A property that is in a popular tourist or holiday destination (23%)

Charlotte Grimshaw, Head of Intermediary Relations, commented: “Our research shows that the younger demographic in particular, are considering a holiday let future, potentially opening up a very interesting new client group for intermediaries, but it will be important to check they have realistic expectations, with many lenders’ criteria including minimum ages and a requirement to already be a homeowner. Brokers can play an important role here in helping prospective short term landlords assess their options.

“As part of the discussion around holiday let criteria, this may even include signposting clients down the buy to let route as a means of gaining additional income and experience with longer term tenants, before borrowers branch out to holiday let later down the line.”

Charlotte Grimshaw continued: “Before potential owners jump on the holiday let bandwagon, intermediaries may also want to educate their clients about the nuances of lenders’ criteria, making them aware that not all lenders will allow them to market their property on short term lettings sites such as Airbnb and Vrbo, or that properties in holiday parks, caravans or lodges, and those of unusual construction method may not always be accepted, for example.

“It’s easy to understand why the idea of owning a holiday let home is so attractive. As people were limited to holidaying in the UK, often within an area they know and love, their eyes were opened to the opportunity of increasing their income, as well as enjoying a property for personal use too. However, intermediaries should also advise their clients to take the time to understand the market, and check out the competition before falling in love with a property that isn’t viable in terms of lettings.”

*Figure calculated by estimated number of UK adults (52.9 million) according to Office for National Statistics, multiplied by the percentage of survey recipients considering buying a holiday let (17%).

** Research was conducted by Opinium Research on behalf of Suffolk Building Society between 22-25 February 2022 amongst 2,000 UK adults aged 18+.